Part of the Certificate Management Cost Guide - Certificate compliance creates a dual burden: visible penalties averaging $14.4M per failure,19 and invisible operational costs consuming $300K-$800K annually in fragmented compliance work that never appears in budgets.

Certificate management failures cost organizations an average of $14.4 million per compliance failure,19 encompassing direct fines, remediation costs, delayed revenue from blocked deals, increased insurance premiums, and reputational damage. Yet the larger problem often goes unmeasured: ongoing compliance overhead fragmenting across teams as quarterly evidence collection, audit preparation, and control testing—operational costs that appear nowhere in finance reports while consuming more capacity than the visible audit fees and platform licenses in budgets.

Note: The scenarios below demonstrate different cost types using a large enterprise example to illustrate the full scope of compliance impact. Your actual costs will vary based on your organization's size, certificate volume, and regulatory requirements. Use our interactive calculator to scale these numbers to your specific situation, or talk to us about your compliance challenges.

This guide breaks down compliance costs by regulatory framework, analyzes real-world audit findings, and reveals both visible penalties and the hidden operational burden that traditional cost accounting cannot detect.

The Dual Compliance Cost Problem

Visible Cost: The $14.4M Compliance Failure

The average compliance failure costs $14.4 million per IBM Security's 2023 Cost of a Data Breach Report,19 broken down into five major cost categories:

1. Direct Regulatory Fines: $500K-$5M

Framework-specific penalties:

GDPR (General Data Protection Regulation):

GDPR imposes the harshest financial penalties for certificate failures, with a maximum fine of €20 million or 4% of global annual revenue, whichever is higher. Certificate-related violations typically result in fines between €500K and €2M for inadequate technical measures under Article 32 (security of processing). The British Airways case illustrates the severity: initially fined £183M (later reduced to £20M) for a data breach involving inadequate encryption controls. When your certificates fail to properly encrypt data in transit, you're potentially violating GDPR's core technical safeguard requirements, and Data Protection Authorities take this seriously. Public notification requirements add reputational damage on top of the financial penalties.

PCI DSS (Payment Card Industry Data Security Standard):

PCI DSS operates differently from government regulations—instead of government fines, you face acquirer and card brand penalties that can devastate your business operations. Violations typically result in $5,000 to $100,000 per month until you achieve compliance, with penalties continuing to accumulate. Certificate violations directly affect Requirement 3.6 covering cryptographic key management. The real threat isn't the monthly fines—it's losing your ability to process card payments entirely, which equals business extinction for most companies dependent on payment processing.

HIPAA (Health Insurance Portability and Accountability Act):

HIPAA enforcement through HHS Office for Civil Rights (OCR) imposes fines ranging from $100 to $50,000 per violation, with a maximum of $1.5 million annually per violation category. Certificate failures can violate §164.312(a)(2)(iv) covering encryption requirements for protected health information. The math becomes terrifying when you realize that certificate expiration affecting patient data access constitutes a violation—and each affected patient record can be counted as a separate violation. State attorneys general can also impose additional penalties, compounding your total liability.

2. Remediation Costs: $500K-$2M Over 12-18 Months

Organizations typically spend $500,000 to $2 million addressing major compliance findings,19 though this visible cost represents only a fraction of total remediation burden.

Visible remediation costs appear in budgets and get CFO approval: emergency consulting fees run $150K-$300K as you bring in external experts who understand your specific compliance framework; tool purchases and deployment consume another $100K-$500K as you implement the monitoring and automation that should have been there all along; and re-audit and certification fees add $50K-$150K to prove you've actually fixed the problems.

The invisible remediation burden fragments across teams over months and never consolidates into a line item. Root cause analysis consumes 200-400 hours across multiple teams as everyone tries to understand how the failure happened. Control enhancement requires 300-600 hours of actual engineering work to implement the fixes. Ongoing evidence collection adds 40-80 hours quarterly for the affected controls going forward. Process documentation and training updates take another 100-200 hours as you capture lessons learned and update procedures. This distributed labor—easily $150K-$300K in engineering time—appears nowhere in remediation project budgets.

3. Delayed Revenue: $2M-$10M+ From Blocked Deals

The most painful cost is often invisible on financial statements: revenue blocked while remediation is in progress.

Enterprise SaaS scenario:

- Average enterprise deal size: $250K-$500K annually

- Sales cycle: 3-6 months

- SOC 2 Type II required for contract approval

- Certification delay: 90-180 days for remediation

Lost opportunity cost calculation:

If 10 enterprise deals in pipeline during 6-month remediation:

= 10 deals × $350K average × 6 months delayed

= $3.5M in delayed first-year revenue

Assuming 3-year contract terms:

= $3.5M × 3 years = $10.5M total contract value delayed4. Increased Insurance Premiums: 20-50% Increase

Cyber insurance underwriters increasingly scrutinize certificate management practices when pricing policies. After a compliance failure, expect your premiums to jump 20-50% ($10K-$75K additional annually for most enterprises). But the financial hit extends beyond just higher premiums: insurers impose higher deductibles, add coverage limitations or outright exclusions for certificate-related incidents, and require control enhancements as a condition of renewal. You're paying more for less coverage, precisely when you've demonstrated you need it most.

5. Reputational Damage: Long-Term Customer Confidence Impact

Brand credibility erosion persists long after you've paid the fines and fixed the technical problems. Public disclosure of compliance failures (often legally required) means customer notifications about inadequate controls, media coverage of regulatory actions, and a permanent competitive disadvantage in enterprise sales. The Ponemon Institute found that 24% of customers abandon purchases due to security concerns,7 and certificate expiration visible to users delivers immediate trust damage. When enterprise customers conduct vendor security reviews, your compliance gaps surface prominently, and contracts get delayed or canceled as buyers question your operational maturity.

Invisible Cost: The Hidden Compliance Burden

While the $14.4M failure cost appears in risk registers, the ongoing operational burden of compliance work remains invisible. Certificate requirements embedded across multiple frameworks create distributed costs that finance teams cannot measure.

What appears in budgets gives CFOs a false sense of knowing their compliance costs: SOC 2 audit fees run $80K-$150K annually, PCI QSA assessments cost $30K-$75K annually, ISO 27001 certification requires $50K-$100K initially plus $25K-$40K for surveillance audits, and compliance platform licenses add another $50K-$200K annually. These visible line items total maybe $210K-$565K annually—and that's what finance teams believe compliance costs.

What doesn't appear in budgets is where the real money goes. Quarterly evidence collection fragments across 50 teams, each spending 2-4 hours per quarter capturing screenshots, updating inventories, and documenting procedures—that's 400-800 hours annually worth $60K-$120K. Audit preparation involves screenshot capture, documentation updates, and policy reviews distributed across teams, consuming 600-1,000 hours annually ($90K-$150K). Control testing happens quarterly: certificate backup/restore tests, monitoring validation, incident response drills add up to 400-600 hours annually ($60K-$90K). Remediation cycles after audit findings—implementing controls, updating procedures—consume another 800-1,200 hours annually ($120K-$180K). None of this appears as "compliance costs" because it's classified as operational overhead across dozens of teams.

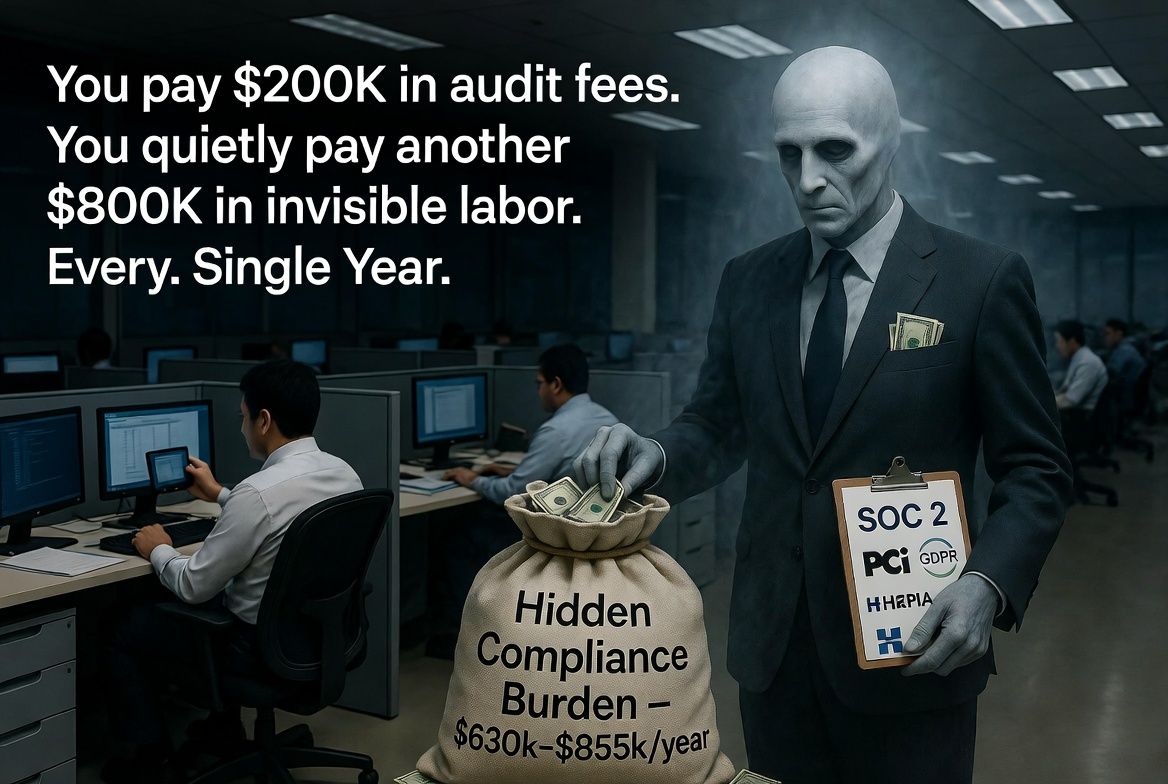

The invisible-to-visible ratio reveals the accounting blind spot: for every $1 in visible compliance costs (audit fees, licenses), organizations spend $1.50-$4.00 in invisible operational overhead. Certificate management—because it touches every compliance framework—represents the largest component of this hidden burden. Finance teams approve $200K in compliance platform licenses without seeing the $800K in distributed labor that platform is meant to eliminate.

Regulatory Framework Requirements

Modern compliance regimes embed certificate management requirements across multiple controls. Understanding specific requirements prevents costly findings—but also reveals the operational burden each framework creates.

SOC 2 Type II: Operational Effectiveness Over Time

SOC 2 Type II certification embeds certificate management requirements across multiple Trust Service Criteria. CC6.1 (Logical and Physical Access Controls) requires certificate-based authentication for systems access, PKI infrastructure for user and service authentication, and key management controls for the certificate lifecycle. CC6.6 (Vulnerability Management) demands continuous monitoring for certificate expirations, remediation of expired or weak certificates, and patching of certificate-related infrastructure. CC6.7 (Encryption) covers TLS certificates for data in transit, certificate management for encryption key lifecycle, and secure key storage with HSM requirements for sensitive data. CC7.2 (System Monitoring) requires alerting for certificate expiration, logging of certificate lifecycle events, and incident response procedures for certificate-related failures.

What auditors demand creates the invisible operational burden. They want evidence of automated certificate discovery—which means someone must maintain the inventory system continuously. They require documented procedures for certificate renewal—and those procedures need regular updates as systems change. Monitoring alerts need defined response procedures that must be tested quarterly. Certificate backup and restore procedures require quarterly testing, pure compliance overhead with no operational value. Management review of certificate incidents means recurring meeting time allocated to discussing certificate problems. Every one of these audit requirements translates to ongoing operational work that appears nowhere in compliance budgets.

The quarterly evidence collection burden illustrates how invisible costs accumulate. Consider what each team managing certificates does per quarter: certificate inventory updates consume 4 hours, screenshot capture for audit evidence takes 3 hours, policy compliance documentation requires 2 hours, and incident response procedure testing adds another 3 hours. That's 12 hours per team per quarter. Scale that across 50 teams times 4 quarters annually, and you've consumed 2,400 hours—$360,000 per year at fully-loaded engineering costs. This appears absolutely nowhere in compliance budgets. Engineers classify it as "operational overhead" and nobody connects it back to the SOC 2 requirements driving the work.

PCI DSS: Payment Card Industry Requirements

PCI DSS Requirement 3.6 governs cryptographic key management with specific mandates for certificates. Under 3.6.1, certificate key pairs must use approved algorithms with minimum key strength of RSA 2048-bit (4096-bit preferred) or ECC P-256 minimum for elliptic curve cryptography. Requirement 3.6.4 mandates key changes for keys reaching end of lifecycle, meaning certificate rotation before expiration, regular key rotation (annually or per defined period), and emergency rotation procedures for compromised certificates.

Payment HSM-specific requirements add another layer of operational complexity: FIPS 140-2 Level 2 minimum (Level 3 for highly sensitive environments), tamper-evident and tamper-responsive hardware, dual control and split knowledge for key management, and regular key ceremonies with documented procedures. These key ceremonies alone represent labor-intensive compliance overhead—scheduling the ceremony, documenting participants, recording the process, storing evidence—all invisible work required to satisfy PCI requirements.

The quarterly validation burden compounds over time. PCI requires continuous compliance validation through quarterly scans and annual assessments. Each quarter, teams spend 12-20 hours validating certificate controls—reviewing certificate inventories, confirming rotation schedules, verifying HSM configurations, documenting scan results. This work appears as "security operations" rather than "PCI compliance costs" in team allocations, making it invisible to finance teams trying to understand total cost of PCI compliance.

HIPAA: Protected Health Information Security

HIPAA §164.312(a)(2)(iv) establishes encryption and decryption requirements as technical safeguards. Organizations must implement mechanisms to encrypt and decrypt electronic protected health information (ePHI), which translates to TLS certificates for all ePHI transmission and certificate-based authentication for ePHI access. The Office for Civil Rights enforces with fines ranging from $100 to $50,000 per violation, with a maximum of $1.5 million annually per violation category. Certificate expiration affecting patient data access constitutes a violation, and each affected patient record can be counted separately—turning a single certificate incident into millions in potential fines.

The annual risk assessment burden represents pure compliance overhead invisible to finance teams. HIPAA requires annual risk assessments covering all technical safeguards. The certificate portion alone—documenting encryption mechanisms across all systems handling ePHI, assessing risks of certificate expiration or compromise, updating policies and procedures—consumes 40-60 hours annually across compliance and IT teams. This work repeats every year, producing no new capabilities, existing solely to demonstrate continued compliance. It appears nowhere in HIPAA compliance budgets because teams classify it as "annual security review" work.

GDPR: EU Data Protection Regulation

GDPR Article 32 requires "appropriate technical and organizational measures" for security of processing. This includes encryption of personal data in transit using TLS certificates, certificate-based authentication for system access, and regular testing and evaluation of security measures. Inadequate certificate controls trigger penalties up to €20 million or 4% of global annual revenue. Typical certificate-related penalties run €500K-€2M when Data Protection Authorities investigate security measures and find systematic failures in certificate management. Public notification requirements compound the damage, turning regulatory findings into reputation disasters.

ISO 27001: Information Security Management

ISO 27001 Annex A controls directly address certificate management. A.10.1.1 requires policies on the use of cryptographic controls, including certificate usage policies, algorithm selection and key lengths, and certificate lifecycle management procedures. A.10.1.2 mandates key management covering certificate key generation, storage and distribution, key rotation and retirement procedures, and HSM usage for sensitive keys.

The surveillance audit cycle creates annual invisible costs. ISO 27001 surveillance audits occur annually to verify that controls remain effective. Certificate-related evidence collection—updating inventories to reflect current state, demonstrating procedure compliance with actual renewal records, showing management review of certificate incidents—consumes 80-120 hours annually in preparation work. This appears nowhere in ISO certification costs because organizations pay external auditors for the audit itself, not recognizing the internal labor required to prepare evidence and demonstrate ongoing compliance. The work happens year after year, an invisible operational tax that finance teams never connect back to the ISO 27001 certificate they proudly display.

Cascading Compliance Failures

A single certificate expiration incident can trigger findings across multiple frameworks simultaneously, each requiring separate remediation with both visible and invisible costs:

Example: Fintech SaaS Certificate Expiration

Consider a payment gateway TLS certificate that expires, causing a 4-hour service disruption affecting customer payment processing. This single incident triggers findings across three compliance frameworks simultaneously, each generating both visible and invisible costs.

SOC 2 Type II impact: Auditors identify two findings—CC6.6 (Vulnerability Management) for the certificate expiration incident itself, and CC7.2 (System Monitoring) for lacking automated alerting that could have prevented expiration. The visible cost hits immediately: Type II certification gets delayed 9 months, blocking $8M in enterprise deals stuck in legal review pending SOC 2 compliance. The invisible cost accumulates over months: root cause analysis consuming 80 hours across security and operations teams, control enhancement requiring 120 hours of engineering work to implement automated monitoring, and ongoing quarterly evidence updates adding 40 hours per quarter going forward. That's $50,000+ in untracked remediation labor that appears as "operational overhead" rather than SOC 2 remediation cost.

PCI DSS impact: The QSA flags Requirement 3.6.4 for failing to rotate the certificate before expiration in a payment processing environment. Visible costs include $50K in acquirer penalties plus $150K for remediation consulting to get back into compliance. Invisible costs compound annually: enhanced quarterly scanning procedures add 32 hours per quarter of validation work, key ceremony documentation requires updates consuming 40 hours, and incident response procedures need revision taking another 60 hours. That's $35,000 annually in ongoing overhead—work that continues year after year, never classified as "PCI compliance costs" in team allocations.

ISO 27001 impact: The surveillance audit uncovers A.10.1.2 finding—key management controls proved ineffective when the certificate expired. Visible cost shows up as $75K in additional audit fees for corrective action verification and follow-up surveillance. Invisible cost spreads across teams: corrective action implementation requires 100 hours of actual work, enhanced surveillance audit preparation adds 50 hours annually going forward as auditors scrutinize certificate controls more carefully. Another $25K in distributed remediation work that finance teams never connect back to the original certificate incident.

Total cascading cost breakdown reveals the accounting blind spot. Visible costs total $8,275,000 (primarily the $8M in blocked revenue, plus penalties and audit fees)—this gets executive attention, appears in board presentations, drives urgent action. Invisible costs total $110,000+ annually (SOC 2 remediation labor, PCI ongoing overhead, ISO corrective action work)—this disappears into "operational overhead" across teams. Finance reports show $8.3M in compliance failure costs. The actual total exceeds $8.4M, but CFOs only see the visible portion. The invisible $110K+ annual burden continues indefinitely, never appearing in any compliance cost reporting.

Prevention: The ROI of Automated Compliance

Automated certificate management delivers 312% ROI over 3 years per Forrester TEI,18 driven by eliminating both visible failure risk and invisible operational burden.

The investment appears as a one-time visible expense: certificate management platform implementation runs $100K-$300K, integration and testing adds $50K-$100K, process documentation requires $20K-$50K, and training consumes $10K-$30K. Total upfront investment: $180K-$480K. This is the number CFOs see and evaluate.

The value delivered splits into visible and invisible benefits. Visible benefits get executive attention: preventing compliance failures eliminates $14.4M average risk,19 blocked revenue risk disappears (worth $5M-$10M in deals that would have been delayed during remediation), and insurance premiums drop back down saving $35K-$75K annually over 4 years.

Invisible benefits exceed the visible savings but appear nowhere in ROI calculations: eliminated evidence collection burden saves $360K annually (those 2,400 hours across 50 teams disappear when automation handles inventory updates), reduced audit preparation overhead recovers $90K-$150K annually (no more screenshot capture and manual documentation), automated control testing saves $60K-$90K annually (quarterly backup/restore tests happen automatically), and prevented remediation cycles eliminate $120K-$180K annually (fewer audit findings mean less remediation work).

The complete ROI calculation reveals the invisible value. At the high end investment of $480K, you're generating annual visible plus invisible savings of $630K-$855K. Over 3 years, that's $1.89M-$2.57M in recurring savings alone. But the real value comes from prevented failures: even one $14.4M compliance failure avoided pays for the entire program 29 times over. Combined 3-year value totals $16.97M ($2.57M in operational savings plus $14.4M in prevented compliance failure), delivering ROI of 3,435%—a 34x return on investment. The payback period runs under 6 months18 because you're eliminating hundreds of thousands in invisible annual costs immediately while also reducing catastrophic failure risk.

Related Resources

- ← Back to Certificate Cost Overview - Complete TCO analysis

- Outage Cost Analysis → - $11.1M average incident costs

- Hidden Cost Analysis → - Opportunity costs, shadow IT, technical debt

- Calculate Your ROI → - Interactive cost calculator

References

- Keyfactor & Ponemon Institute. (2023, March 21). 2023 State of Machine Identity Management Report.

- Ponemon Institute & Venafi. (2015). 2015 Cost of Failed Trust Report.

- Forrester Consulting. (2024, August). TEI of Sectigo Certificate Manager.

- IBM Security. (2023). Cost of a Data Breach Report 2023.